PEP-11 Proponents lawsuit against former prime minister casts a deep gloom over local waters

The findings of the Bell Inquiry (Inquiry into the Appointment of the Former Prime Minister to Administer Multiple Departments) have brought to the attention of residents who campaigned for years against the PEP-11 Licence renewal, and its cancellation by former Prime Minster Scott Morrison, that this may yet occur anyway.

The Inquiry received 62 submissions in response to its terms of reference, including an extensive one from Asset Energy Pty Ltd.

The Hon. Justice Bell went extensively into the PEP-11 decision. The Inquiry report noted that in relation to the appointment to administer DISER, Mr Gaetjens, former Secretary of the Department of the Prime Minister, considered that Mr Morrison had been made aware of the risk of successful legal challenge, in light of his public statements, before he determined the PEP-11 applications.

'The 2021 appointments were not taken with a view to Mr Morrison having any active part in the administration of the department but rather to give Mr Morrison the capacity to exercise particular statutory power should the minister charged with responsibility for the exercise of that power propose to do so in a manner with which Mr Morrison disagreed, or fail to make a decision that Mr Morrison wanted to be made. In terms of the functioning of the departments this was as Dr Gordon de Brouwer PSM, Secretary for Public Sector Reform, observes “extremely irregular”.’ Justice Bell's report notes

The Hon. Justice Bell's report is available here: www.ministriesinquiry.gov.au

On October 17th 2022 Asset Energy Pty Ltd. issued an ASX announcement advising that on October 5th 2022, a bundle of documents relating to the former Prime Minister’s purported decision were provided to the Federal Court of Australia by the Commonwealth Minister for Resources.

BPH announced it had applied to the Federal Court pursuant to section 5 of the Administrative Decisions (Judicial Review) Act 1977 (Cth) and section 39B of the Judiciary Act 1903 (Cth) to review the decision of the Commonwealth-New South Wales Offshore Petroleum Joint Authority (Joint Authority), constituted under section 56 of the Offshore Petroleum and Greenhouse Gas Storage Act 2006 (Cth) (Act), to refuse to vary and suspend the conditions of Exploration Permit for Petroleum No.11 (PEP 11 Permit), pursuant to section 264(2) of the Act, and to refuse to extend the term of the PEP 11 Permit, pursuant to section 265 of the Act. BPH revealed that Asset, which holds an 85% operating stake in the 4,500-square kilometre permit PEP-11 with joint venture partner Bounty Oil and Gas (ASX: BUY), confirmed the “bundle of documents” have been made publicly available and relate to Mr Morrison’s purported decision.

Advent submitted to the National Offshore Petroleum Titles Administrator (NOPTA) an application to enable the drilling of Seablue-1 approx.26 km SSE of Newcastle offshore NSW. The PEP11 Joint Venture proposes to proceed with the drilling of Seablue subject to approvals from NOPTA and other regulatory authorities, and financing. The current permit expiry date was February 12th 2021.

The permit remains in place and in good standing during the NOPTA review period.

The National Offshore Petroleum Titles Administrator (NOPTA's) function is to administer titles and data management for petroleum and greenhouse gas (GHG) titles in Australian Commonwealth waters. NOPTA’s 'vision' is 'to contribute to national prosperity through administering the development of Australia’s offshore oil and gas resources and enabling the storage of greenhouse gas'. NOPTA supports the management of the offshore petroleum and GHG titles by providing expert advice, administration, compliance monitoring and data management in accordance with the Offshore Petroleum and Greenhouse Gas Storage Act 2006 (OPGGS Act).

NOPSEMA cooperates with the Titles Administrator (NOPTA) in matters relating to the administration and enforcement of this Act. NOPSEMA, the National Offshore Petroleum Safety and Environmental Management Authority, is where an oil and gas company must first submit relevant risk management plans for any offshore petroleum or greenhouse gas storage activity. Submitted plans can include safety cases, well operations management plans, offshore project proposals and environment plan.

Public 'feedback' is not sought on many of these developments or extension applications as it is the stakeholders (proponents) that are the focus.

The public may make a 'submission', usually run for 30 days, on an environment plan to NOPSEMA when these are made available. However, the function and 'vision' is at the core of what will occur and the public must find that listing on the NOPSEMA website to make a submission. Notification to the areas that may be impacted is not notified to these places in a readily available way through advertisements or any other method.

This is why there has been a prolonged public campaign by thousands of residents to regain a voice in what was and is still proposed.

The NEATS PEP-11 webpage lists the Indicative Expenditure (AUD) so far as $21,100,000. The one exploration well indicative expenditure is listed at $15,000,000.

The permit has been renewed, since first being issued in 1999, in 2012, 2013, 2015, 2019 and 2020 for various works programs, including a 2D Seismic Survey, Geotechnical Studies. Future works listed on NEATS included a proposed Exploration Well and a 3D Seismic Survey over 500 square kilometres. Asset applied to replace the 'acquisition of 3D seismic data' with the drilling and gathering of data from that drilling.

The Department of Industry, Science and Resources publicly available information released following a freedom of information (FOI) request in 2021, 'Disclosure log number: 21/067/69653' - Specifically the "NOPTA Recommendation for exploration Petroleum Exploration Permit-11 (PEP-11) lodged 23/01/20 NEATS reference Z4NMT2 - 23 January 2020". The Disclosure Log, first made publicly available on November 11 2021, revised publication made available on November 14 2022, records Asset have submitted the application for an extension to meet their drilling and well program and that NOPTA finds the variation request reasonable and recommended approval for the 24 months suspension to Permit Year 4 and a corresponding 24 months extension of the permit term in accordance with the Act and on merit and approval for a secondary variation to Permit Year 5 in accordance with the Act and Guideline.

Following the release of those Federal Government discovery documents, and the report of the Bell Inquiry, BPH Energy’s (ASX: BPH) investee Asset Energy continues to allege former Australian Prime Minister Scott Morrison was biased in his decision to not renew the offshore New South Wales gas exploration permit PEP-11. Asset states that Mr Morrison was not only biased but “failed to afford procedural fairness” in his decision to cancel the permit.

In early 2021 Asset announced they had secured a rig and also appointed Professor Peter J Cook, an Australian expert on CCS, to join the team working to develop the huge PEP-11 offshore gas field.

More recent statements, that Asset have commenced with an environment plan, one of the requirements to be submitted, is an indication they expect to proceed, despite the cancellation of the licence.

After the revelations Mr. Morrison took Ministerial responsibility in a number of portfolios including Resources, Prime Minister Anthony Albanese ordered the inquiry into Mr Morrison’s appointments and decisions (which includes the PEP-11 decision).

The federal case proceeded alongside the inquiry ordered by Prime Minister Anthony Albanese into Mr Morrison’s “secret” self-appointment to five ministerial portfolios, including resources, in 2020 and 2021.

The court case continues after the Inquiry and is scheduled for a 2 day hearing in March 2023. It lists the NSW Minister for Regional NSW along with the then Federal Minister for Resources and the former Prime Minister as Respondents.

The proponent is seeking a review of the decision and recently raised $1.2 million through a share placement with plans to attribute some of the funds to its PEP-11 drilling program and to invest in hydrogen and CCS tech, also related to PEP-11.

Former High Court justice Bill Gummow recently questioned the validity of Mr Morrison’s additional ministerial roles in a note in the Australian Law Journal. He pointed out the former prime minister’s failure to gazette and publish the appointments was not in compliance with Section 64 of the Constitution.

“How are clandestine ministers to be restrained from exceeding their powers if their identity was not disclosed as a component of their appointment process under section 64?” Justice Gummow wrote.

“How is a minister to be called to account to the House or the Senate for the administration of the portfolio he or she holds in secret?” he added.

The PEP-11 was a 'captains call' announced by former Prime Minister Morrison on December 16 2021 as the 2022 Federal Election drew closer and among a raft of measures the then incumbent government was taking to secure another term. The State of the Environment report, due to be released, wasn't, statements in the Budget announcements, along with pursuing a 'gas fired recovery' were viewed as more 'head in the sand' or digging bigger coal mines and gas wells through taxpayer subsidies allocated by the LNP.

The PEP-11 cancellation announcement heading into an election was expected but not overly anticipated as it was clear then Minister for Resources Keith Pitt was in favour of approval for the licence extension and the documents now released reveal NOPTA, through its functions, also recommended approval for the extension of the licence.

The Censure Motion passed on November 30th, along with the Bell Inquiry report and publicly released documents relating to the court case, elucidate that it's not, after all, completely over regarding the PEP-11 'works' off peninsula shores.

In rising to support the Motion ‘Member for Cook – Censure’ Mackellar MP Dr. Sophie Scamps stated,

'Such conduct obviously has widespread ramifications, and none of the appointments could have been closer to home for my electorate of Mackellar than the former Prime Minister's secret appointment as the Minister for Industry, Science, Energy and Resources. One of my key objectives, from the first day I launched my campaign for election, was to end the PEP-11 licence. The PEP-11 licence is a petroleum exploration permit granted by the Commonwealth government for an area of ocean floor that extends all the way from Manly to Newcastle. Community opposition to any drilling for oil and gas off our coastline was as broad as it was strong. Clearly, the former Prime Minister was aware of the political expediency of abolishing the PEP-11 licence. We now know that, with the election looming, he stepped in and secretly appointed himself as minister to override the existing resources minister and reject the renewal of the permit.

That announcement was made by the Prime Minister in December 2021, 10 days after I launched my candidacy. It was clear there was a political purpose. Whilst the community welcomed this decision as a win for the people, there is now deep concern that a lack of proper procedure will expose this decision to challenge in the Federal Court. I welcome the government's confirmation that it will accept Justice Bell's six recommendations to correct the serious deficiency in governance arrangements exposed by the member for Cook's unfathomable conduct. I support this censure motion.'

This also brings into paradoxical relief the memory of Warringah MP Zali Steggall being mocked and even derided in parliament by some coastal Liberal members for her Offshore Petroleum and Greenhouse Gas Storage (Stopping PEP11) Bill 2021 - then to be tabled in October 2021 - in two instances because that Bill could prompt 'a court case by the Proponents' which could 'cost the Australian public'.

As recorded in Pittwater Online's August update on the PEP-11 court case, when it was revealed Mr. Morrison had appointed himself to multiple ministries, those opposed to seismic testing off the coast, opposed to exploration wells, may have to oppose PEP-11 again.

Mackellar MP Sophie Scamps stated then, ''The community here on the Northern Beaches, as well as communities all along our coast up to Newcastle have rejected the proposed PEP-11 licence.

''Here in Mackellar our community is not willing to risk a potential environmental catastrophe off our coastline and will never accept offshore drilling for oil and gas.

''If the PEP-11 proposal is revived, we will fight it every step of the way.

I strongly urge the Albanese and Perrottet Governments to resist the lobbying efforts of the fossil fuel industry. We should listen to the science, and the wishes of our community and ensure the PEP-11 exploration licence remains dead in the water.

The reality is we should not be opening up any more oil or gas wells – either offshore or onshore. The science is clear. It’s time we focused on investing in renewables and the clean technology industries of the future and leave fossil fuels in the ground, where it belongs.'' Dr. Scamps said

This week's Censure Motion, along with the details now being tabled in the papers made public, and the submissions to the Bell Inquiry and its report, are a stark contrast to December 2021. Instead of joy there is now an ignominious cast over the career of a long-serving politician, over the integrity of our democracy and a gloom over those glorious waters where so much of our marine plants, fish and animals live.

This generation states it is living a time where the sharp differences between those who are just for money and those who are just for what cannot be bought or replaced have never been more evident. However, the pages of history are filled with the same, that too always been going on; those who wanted everything and would destroy everything to have it, and those who were richer than that with nothing at all. Both sides claim that theirs is the way forward, the better future.

Ultimately, last weeks developments prompt the obvious question; how much could it cost to save this place, or what is left? How much may the PEP-11 case eventually cost in dollar terms should the cancellation of the licence remain intact, or, as recommended for approval, proceed from one well to many?

According to the aspect instanced in this study of cancelling the same, published earlier this year, billions.

How treaties protecting fossil fuel investors could jeopardize global efforts to save the climate – and cost countries billions

Fossil fuel companies have access to an obscure legal tool that could jeopardize worldwide efforts to protect the climate, and they’re starting to use it. The result could cost countries that press ahead with those efforts billions of dollars.

Over the past 50 years, countries have signed thousands of treaties that protect foreign investors from government actions. These treaties are like contracts between national governments, meant to entice investors to bring in projects with the promise of local jobs and access to new technologies.

But now, as countries try to phase out fossil fuels to slow climate change, these agreements could leave the public facing overwhelming legal and financial risks.

The treaties allow investors to sue governments for compensation in a process called investor-state dispute settlement, or ISDS. In short, investors could use ISDS clauses to demand compensation in response to government actions to limit fossil fuels, such as canceling pipelines and denying drilling permits. For example, TC Energy, a Canadian company, is currently seeking more than US$15 billion over U.S. President Joe Biden’s cancellation of the Keystone XL Pipeline.

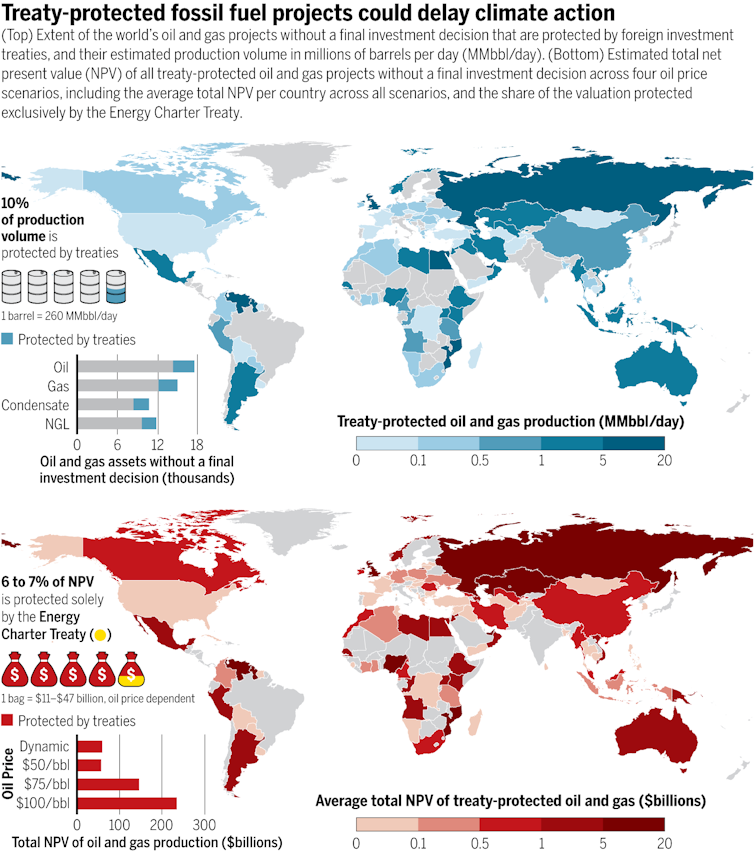

In a study published May 5, 2022, in the journal Science, we estimate that countries would face up to $340 billion in legal and financial risks for canceling fossil fuel projects that are subject to treaties with ISDS clauses.

That’s more than countries worldwide put into climate adaptation and mitigation measures combined in fiscal year 2019, and it doesn’t include the risks of phasing out coal investments or canceling fossil fuel infrastructure projects, like pipelines and liquefied natural gas terminals. It means that money countries might otherwise spend to build a low-carbon future could instead go to the very industries that have knowingly been fueling climate change, severely jeopardizing countries’ capacity to propel the green energy transition forward.

Massive potential payouts

Of the world’s 55,206 upstream oil and gas projects that are in the early stages of development, we identified 10,506 projects – 19% of the total – that were protected by 334 treaties providing access to ISDS.

That number could be much higher. We could only identify the headquarters of project owners, not the overall corporate structures of the investments, due to limited data. We also know that law firms are advising clients in the industry to structure investments to ensure access to ISDS, through processes such as using subsidiaries in countries with treaty protections.

Depending upon future oil and gas prices, we found that the total net present value of those projects is expected to reach $60 billion to $234 billion. If countries cancel these protected projects, foreign investors could sue for financial compensation in line with these valuations.

Doing so would put several low- and middle-income countries at severe risk. Mozambique, Guyana and Venezuela could each face over $20 billion in potential losses from ISDS claims.

If countries also cancel oil and gas projects that are further along in development but are not yet producing, they face more risk. We found that 12% of those projects worldwide are protected by investment treaties, and their investors could sue for $32 billion to $106 billion.

Canceling approved projects could prove exceptionally risky for countries like Kazakhstan, which could lose $6 billion to $18 billion, and Indonesia, with $3 billion to $4 billion at risk.

Canceling coal investments or fossil fuel infrastructure projects, like pipelines and liquefied natural gas terminals, could lead to even more claims.

Countries already feel regulatory chill

There have been at least 231 ISDS cases involving fossil fuels so far. Just the threat of massive payouts to investors could cause many countries to delay climate mitigation policies, causing a so-called “regulatory chill.”

Both Denmark and New Zealand, for example, seem to have designed their fossil fuel phaseout plans specifically to minimize their exposure to ISDS. Some climate policy experts have suggested that Denmark may have chosen 2050 as the end date for oil and gas extraction to avoid disputes with existing exploration license holders.

New Zealand banned all new offshore oil exploration in 2018 but did not cancel any existing contracts. The climate minister acknowledged that a more aggressive plan “would have run afoul of investor-state settlements.” France revised a draft law banning fossil fuel extraction by 2040 and allowing the renewal of oil exploitation permits after the Canadian company Vermilion threatened to launch an ISDS case.

Securing the green energy transition

While these findings are alarming, countries have options to avoid onerous legal and financial risks.

The Organization for Economic Cooperation and Development is currently discussing proposals on the future of investment treaties.

A straightforward approach would be for countries to terminate or withdraw from these treaties. Some officials have expressed concern about unforeseen impacts of unilaterally terminating investment treaties, but other countries have already done so, with few or no real economic consequences.

For more complex trade agreements, countries can negotiate to remove ISDS provisions, as the United States and Canada did when they replaced the North American Free Trade Agreement with the United States-Mexico-Canada Agreement.

Additional challenges stem from “sunset clauses” that bind countries for a decade or more after they have withdrawn from some treaties. Such is the case for Italy, which withdrew from the Energy Charter Treaty in 2016. It is currently stuck in an ongoing ISDS case initiated by the U.K. company Rockhopper over a ban on coastal oil drilling.

The Energy Charter Treaty, a special investment agreement covering the energy sector, emerged as the greatest single contributor to global ISDS risks in our dataset. Many European countries are currently considering whether to leave the treaty and how to avoid the same fate as Italy. If all country parties to a treaty can agree together to withdraw, they could collectively sidestep the sunset clause through mutual agreement.

The global transition

Combating climate change is not cheap. Actions by governments and the private sector are both needed to slow global warming and keep it from fueling increasingly devastating disasters.

In the end, the question is who will pay – and be paid – in the global energy transition. We believe that, at the very least, it would be counterproductive to divert critical public finance from essential mitigation and adaptation efforts to the pockets of fossil fuel industry investors whose products caused the problem in the first place.

[Like what you’ve read? Want more? Sign up for The Conversation’s daily newsletter.]![]()

Rachel Thrasher, Law Lecturer and Researcher at the Boston University Global Development Policy Center, Boston University; Blake Alexander Simmons, Postdoctoral Research Fellow in the Human Dimensions of Natural Resources, Colorado State University, and Kyla Tienhaara, Canada Research Chair in Economy and Environment, Queen's University, Ontario

This article is republished from The Conversation under a Creative Commons license. Read the original article.