May 1 - 31, 2025: Issue 642

Government Response to Upper House inquiry into the ‘Ability of local governments to fund infrastructure and services’ signals Special Rates Variations will be tied to specific projects - time limited

On Wednesday May 7 the Minns Labor government stated it remains committed to ensuring NSW councils are efficient and financially sustainable, announcing it will support 15 of the 17 recommendations from the NSW Parliament’s Upper House inquiry into the ‘Ability of local governments to fund infrastructure and services’.

Worth noting is the Government has stated the Special Variation process will return to being used solely by councils to fund specific projects or programs supported by the community, and be time limited, not permanent.

In its Response the Government stated:

‘’Many recent Special Variations are not time-limited or targeted but are used to permanently increase a council’s rate base to address broader financial sustainability concerns. As described in the response to Recommendation 2, the Government believes that a Comprehensive Spending Review is necessary before a council applies for higher permanent rating income. However, many councils may still require additional income for special projects or programs on a short-term basis without seeking a permanent increase in their rates.

To meet this need, the current Special Variation process will be retargeted to focus on funding for specific places, projects or programs.’’

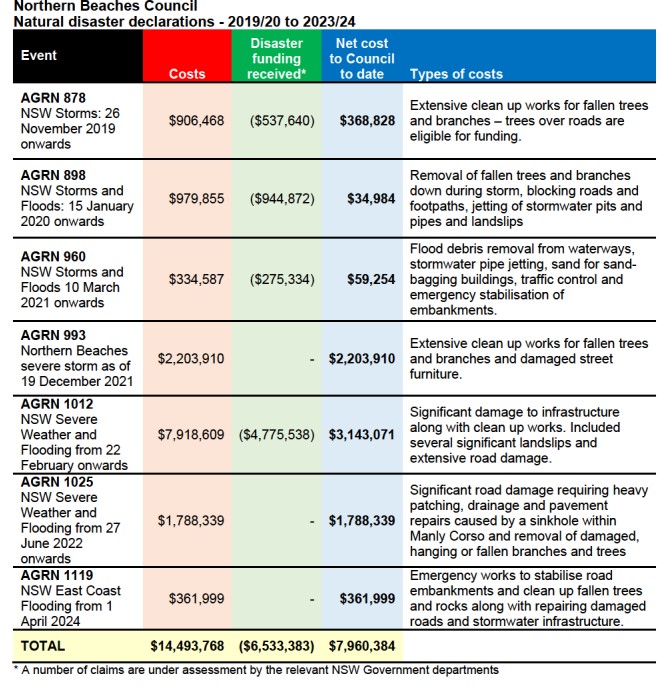

During the inquiry it was divulged that the Northern Beaches Council has almost $8 million added on costs through all it must do to respond to the increased amount of damage caused by weather events. These costs that are not met through disaster funding received and are expected to grow over the coming years.

The inquiry was established in March 2024 at the request of the Minister to examine long-held concerns from the sector about the financial challenges impacting councils across the state.

The inquiry heard cost pressures have increased significantly in recent years, impacting councils’ ability to reliably and affordably provide the services communities rely upon, especially in rural and regional areas.

While many of the challenges relating to the financial sustainability of councils are not new, band-aid solutions by the previous Liberal-National government have done little to fix systemic issues which are threatening the long-term viability of the sector.

The Minns Labor government’s response to the inquiry recognises the need to preserve local democracy and councils’ autonomy, while also ensuring they can sustainably provide services over the long-term without financially burdening ratepayers.

The government has proposed five key actions:

- The Independent Pricing and Regulatory Tribunal (IPART) will continue to oversee council rates to ensure councils’ revenue keeps pace with cost changes, while protecting ratepayers from excessive rate hikes

- Councils that want to permanently increase their rates will be required to submit a Comprehensive Spending Review to IPART that forensically examines their expenditure as well as their revenue

- The Special Variation process will be simplified and used solely by councils to fund specific projects or programs supported by the community

- Local government financial statements and reporting will be streamlined to increase transparency and councillor and public oversight over council spending

- Establishing an Expert Advisory Panel of experienced general managers, finance directors and other local government experts to support the government in delivering its reforms

The government will also audit local government fees and charges, to ensure they reflect inflation and changes in market costs. Models for distributing state government grants to councils will also be assessed so that councils continue to receive sustainable and equitable funding.

These reforms alongside those already in progress including rewriting the councillor Code of Conduct system, aim to enhance the reputation of local government as a robust, independent tier of government.

They will improve transparency in decision making and provide councillors with the financial information they need to be visibly in control of their councils to deliver local government services for their communities into the future.

The government’s response to the inquiry can be viewed on the NSW Parliament website here.

Minister for Local Government Ron Hoenig said:

“The role that councils play in building connected communities and fostering local development cannot be overstated.

“But the reality is, many councils are struggling under financial pressures and this is having flow-on effects to communities in the form of higher rates or reduced services.

“It’s clear the status quo is not sustainable for councils and it’s not fair on communities who will lose out. The ratepayers of NSW deserve assurance their money is being put to good use and that councils are doing all they can to tighten their belts, just like families are doing across the state.

“Fixing entrenched systemic issues won’t happen overnight, but the Minns Labor government is serious about delivering long-term structural changes to the sector.

“Reforms that ensure councils are being efficient with their money and that decisions that financially impact ratepayers are made with them, not for them. This will come from councillors having transparent and digestible information about their council’s financial position, so they can make more informed decisions about what their community needs most.

“I thank the committee for their work throughout this inquiry and all the councils and local government stakeholders for their input.”

Councils’ financial sustainability crisis, State Government response a good first step: LGNSW

The peak body for local government has cautiously welcomed the State Government’s response to a financial sustainability crisis that is threatening the viability of the sector.

LGNSW President Mayor Phyllis Miller OAM said it was helpful for the sector to finally receive some clarity about the State Government’s position in response to the 17 recommendations of a Parliamentary inquiry into the ability of local governments to fund infrastructure and services and to get an understanding of their vision for longer term reform.

"I do thank the Government for its commitment to involve the sector in shaping and implementing the necessary reforms going forward through the establishment of an Expert Advisory Panel and we’re grateful for their preparedness to partner with councils in seeking that Financial Assistance Grants from the Commonwealth return to 1 per cent of Commonwealth taxation revenue," said Mayor Miller.

“However, some of the Government’s suggested measures for addressing financial sustainability concerns could actually add to the administrative burden currently on councils.

"For instance, in regard to the process for Special Rate Variations, the Government is suggesting councils undergo a Comprehensive Spending Review – something we would argue that councils already do via their annual budget process. This is carried out by their democratically elected body in line with their community’s wishes."

"While there is a lot in the Government response that we can absolutely agree on, there are a number of key areas where more detail is required – such as the absence of leadership on reducing cost shifting or addressing issues with the development contributions framework.

"On this and other aspects of the report, I look forward to working with Minister Hoenig and with the Government to develop and implement the reforms that will be required.

"Overall, we see this as a first step in the reform of local government financial sustainability. Councils stand ready to work with the State to make meaningful change and bring about genuine and substantial reform to the financial viability of councils.

On November 29 2024 the Standing Committee on State Development tabled its report into the ability of local governments to fund infrastructure and services. The inquiry examined whether the level of income local councils receive adequately meets the needs of their communities and highlighted the financial challenges councils are experiencing.

A key recommendation of the committee's report is that the NSW Government redesign the local government rating system, including reassessing council base rates, and seek to implement measures to provide local governments greater flexibility to set their own rates, whilst emphasising the importance of keeping rates affordable and maintaining safeguards to ensure rates meet community needs.

The Hon Emily Suvaal MLC, Chair of the Standing Committee on State Development, said: 'It is clear to the committee that councils are experiencing significant challenges which are threatening the financial sustainability of the sector. As the level of government closest to the people of New South Wales, it is important to ensure that local governments can deliver the services communities expect and need in an efficient and financially sustainable way.'

The Chair continued: 'This inquiry has been an important step in examining the long-term financial sustainability of the local government sector, and the committee has made a number of key recommendations, which will go some way in addressing some of the cost pressures local governments face in delivering community services and assets and infrastructure.' Some of the other recommendations in the report call for the government to:

- advocate to the Australian Government to increase the federal taxation revenue distributed via Federal Financial Assistance Grants from 0.5 per cent to 1 per cent

- consider state grant models that provide a more secure and sustainable source of funding to local councils and take into account the preference of local councils for predictable grants that are determined in a timely manner

- continue to improve the timeliness of disaster recovery assistance funding to local councils by utilising funding agreements such as tripartite arrangements

- identify opportunities to reduce cost shifting to local government, and undertake greater consultation with local government prior to making decisions that may result in cost shifting.

The committee's report and other inquiry documents can be found on the committee's webpage.

NBC Carrying $8 Million Climate Change Deficit

During the Inquiry a question to the Chief Financial Officer, Northern Beaches Council revealed a deficit of almost $8million in costs sustained by weather events.

The CFO's Answers to Questions on Notice the response to 'What types of costs are incurred in response to a natural disaster?' was:

The Northern Beaches is highly exposed to a raft of natural hazards with current data indicating:

- Over 22,000 properties are affected by flood;

- 19,000 properties are bush fire prone;

- 63,000 properties exposed to moderate to high geotechnical risk, and

- close to 5000 properties affected by coastal hazards.

The recently released NSW State Disaster Mitigation Plan estimates that by 2060 the Northern Beaches will have the highest Total Average Annual Losses in NSW by 2060, with estimated losses of close to $1 billion dollars per annum to the built environment alone.

The following table sets out the types of costs incurred by Council in the past 5 years for natural disasters. Northern Beaches Council Natural disaster declarations - 2019/20 to 2023/24:

The NBC’s CFO also provided additional answers to supplementary questions - ;

Why do you think the current rate peg benefits local councils?

The rate peg is mainly based on the Base Cost Change (BCC) developed by IPART for local government in New South Wales. The BCC measures annual price changes in councils’ operating and capital expenses that are funded through general (rates) income.

As such, it provides a benefit by adding a level of discipline for councils in their budgetary processes by providing a baseline that serves as a reasonable and defined starting point for comparison purposes for the level of cost increases. This broad-based independent assessment also provides assurance to the community of the need for an increase in rates each year.

While the rate peg helps limit the impact of increases in the short-term on ratepayers, it does not allow councils to adjust their rates to reflect actual changes in their costs. Nor does it take account of differences between councils without the need for a special rate variation application which is resource intensive, costly and can be politically contentious. It does not take account of changes in service levels, the impacts of extreme weather events, the impacts of climate change, cost shifting by other levels of government and operational costs associated with growing populations. In addition, it does not take into account that councils have different capacities to generate income and their financial performance and service needs are variously affected by geography, demographics and community preferences.

Allowing councils to add a small percentage to the rate peg determined by IPART in years where it was appropriate, following consultation with their communities through the IP&R process, for those costs that aren't covered by the rate peg would avoid the need for large special rate variations requiring a resources intensive and costly process which is unfair on ratepayers and does not adequately reflect intergenerational equity.

Special Rate Variation Under Pittwater Council

Given the recent ‘consultation’ undertaken by the council via a directed-to survey residents state was constructed to produce the desired response, the level of trust diminished through the recent SRV consultation is still resonating anger through the community – especially as people continue to state the data pointed overwhelmingly to a rejection of a permanent 40% increase via an SRV.

The Special Rate Variation framework has been historically used for time-limited special projects that a council needed additional resources to complete. Successful examples include the Mona Vale Surf Club build funding which was raised by Pittwater Council, and through a grant secured by former Pittwater MP Rob Stokes.

IPART granted Pittwater Council’s application for a special variation to its general income for the period from 2011/12 to 2013/14.

The increase in 2011/12 also included the value of an existing Environmental Infrastructure Levy (EI Levy) that was due to expire in June 2012. Thus the council was effectively seeking to cancel this levy 1-year early and replace it with a special variation of a similar size that will be incorporated into its rates base.

Pittwater Council indicated that it would use the income raised by this special variation to complete all projects associated with the EI Levy as planned by June 2012. After that time, it would use this income, plus the requested increases in 2012/13 and 2013/14, to fund its Community Priority Expenditure program.

The Community Priority Expenditure program was a $38.9m program of infrastructure maintenance and environmental works the council planned to complete over the next 10 years. It mostly comprised capital works, including significant expenditure on roads, footpaths and drainage, natural environment protection, as well as improving facilities such as surf clubs (Newport, Avalon and Mona Vale), rock pools, sports fields and reserves, managing bushfire and flood risk, and upgrading libraries.

Pittwater Council indicated that this program of works was identified by applying its Integrated Planning and Reporting Framework (IPRF), and reflected the priorities and objectives of its community.

The approved special variation percentage included the rate peg. These increases represented a cumulative increase of 22.3% for these 3 years, or 12.1% above the assumed rate peg increases.

The increase then ceased.

Pittwater Council’s application indicated that it implemented an extensive community consultation and engagement strategy in relation to the special variation. This strategy included:

- Publishing a draft delivery program and budget for 2010-14 and holding a public meeting to discuss it in May 2010.

- Carrying out a community survey in July 2010 to gauge residents’ satisfaction with the council’s service delivery and obtaining feedback on areas that were most important to residents. Council then briefed all 4 reference group meetings, comprising of registered community groups, about the survey results and discussed their implications.

- Holding public meetings in Avalon and Mona Vale during March 2011 to discuss the requested special variation.

- Making a designated contact person available for residents to ask specific questions about the requested special variation (this person received 23 calls from residents seeking clarification on the special variation and the rate rises).

- Adopting web-based engagement strategies designed to reach younger members of the community. For example, comments could be made and answers given on various web sites and social networks, including Facebook and Twitter.

- Establishing a General Manager’s blog on which members of the community could voice their opinions on the requested special variation and rates rises, and the General Manager could respond.

- Issuing media releases about the requested special variation and rate rises to local media. q Distributing an on-line newsletter every month.

- Undertaking a telephone survey to explain and gauge community views on the requested special variation and rate rises.

- Sending a special edition of the “Pittwater Report” to every ratepayer in February 2011. This report explained the requested rate increases and the council’s rationale for seeking the special variation.

- Expanding the council’s website to give detailed information about the requested special variation.

- Inviting submissions from ratepayers for 5 weeks up to the 11 March 2011

Alike the NBC, Pittwater Council indicated that it received submissions (256) from the public about the requested special variation and rate rises, and that 52% of these submissions were in favour.

Some of the issues raised by ratepayers who were not in favour included that:

- the council does not have a base charge in its rating structure

- they needed assurance that the funds raised would be spent as promised

- the funds being used for Scotland Island may not be equitable

That has been a primary concern among Pittwater residents in regards to the NBC’s Permanent 40% SRV proposal – will the millions raised in Pittwater actually be spent in Pittwater?

The current Draft Budget, open for feedback until May 25, and which includes spends should the SRV be approved and what that will be allocated towards, does not add up, at this stage, to what will be extracted from Pittwater being spent in Pittwater.

Further drafts may change that allocation.

The $38.9 million raised through the Pittwater Council's 3 years only SRV for the projects listed, and being undertaken prior to the forced amalgamation of Pittwater Council with Warringah, again, are still available to read - and comprises an extensive list of works and new infrastructure that ran to 3 pages.

Pittwater Council’s application for a special variation Determination of June 2011, is still available on IPART’s website.

The 'Ability of local governments to fund infrastructure and services' Report and Response are available on the Government's webpage.

Australian Local Government Association (ALGA) President’s Update – 9 May 2025

ALGA President Mayor Matt Burnett said over the past three years, the Albanese Government had listened to local government concerns, and partnered with councils to deliver new and increased funding.

“We thank the Government for responding to the poor state of our local roads by permanently doubling Roads to Recovery funding from $500 million to $1 billion per year, while also increasing Black Spot funding,” Mayor Burnett said.

“To protect our communities from increasingly frequent and severe fires, floods and cyclones, the Government also established a new $200 million per year Disaster Ready Fund (DRF), which has been strongly embraced by councils.

“Recognising the key role councils play in reducing emissions, they created a new $100 million Community Energy Upgrades Fund.

“However our biggest challenge is our ongoing financial sustainability, and we were pleased the Government launched a Parliamentary inquiry into this issue and released an interim report earlier this year.

“ALGA looks forward to working with the next Australian Government on the inquiry’s final recommendations and delivering improvements that will support every council and community across the nation. Councils stand ready to deliver national priorities, but we need sustainable funding.

“We believe this work should be progressed through National Cabinet, which the Government returned ALGA to in 2022.”

Mayor Burnett said as Australia’s important third tier of government, councils are committed to building stronger federal/local government partnerships.

“When the Albanese Government invited ALGA to attend National Cabinet, and relaunched the Australian Council of Local Government, it brought councils back to the table and recognised us as a valued partner,” Mayor Burnett said.

“Local perspectives support better national decision making, and we look forward to working with the next Government to ensure the needs of every community are considered and met.”

This week ALGA President Mayor Matt Burnett said:

“I congratulate Prime Minister Anthony Albanese and the Labor Government for being re-elected for a second term.

It’s vital the final report recommends a significant increases in untied, formula-based funding that will support all councils to plan for the future of our communities. We can’t afford to be distracted by funding formula changes when a significant lift in funding is needed to support all councils.

Financial sustainability remains the biggest threat to our sector, and we look forward to working with the returned government to address this issue.”

''I sincerely thank all the councils and local government leaders who supported and embraced our successful Put Our Communities First national election campaign.

Over a four-week period, we collectively advocated for an additional $3.5 billion in federal funding that we need to bring us back to one per cent of national taxation revenue. We emphasised national priorities need local delivery, and look forward to working with the new government on formula-based funding pools for housing and community infrastructure, safer roads, emergency management and climate adaptation.

While the election may be over, our fight continues, and I urge all of you to keep talking to your local representatives about the urgent need for fair and sustainable funding for all councils.

The percentage of national taxation collected by councils recently hit a 15-year low, so the untied, formula-based funding we receive from the government is more important than ever.”

Previous reports:

- IPART Consult on NBC SRV Now Open: Closes March 17, 2025

- Outraged Pittwater Community Fights To Stop Rising Costs Of Failed Merger; Renews Call To Reinstate Pittwater Council

- Northern Beaches Council Passes Motion to Apply for a Permanent 40% Increase in Rates

- Rates Variations Options 1 to 4 Prompt ‘Option 5’: Reinstate Pittwater Council

- Council Consultation on Special Variation to Rates to commence this week

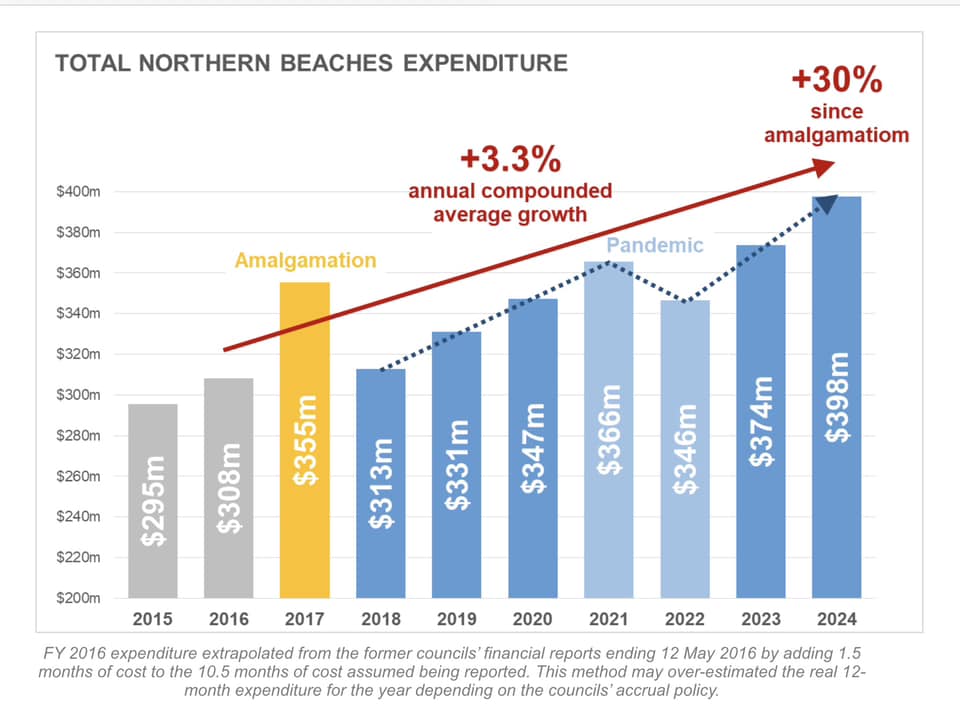

The Council is Unfit for the Future

> $90m more than 8 years ago

> almost $1,000 more per dwelling every year

> close to $40m more than eight years ago

- Where did the cash of Pittwater go?

- How could ratepayers believe that this council can be fixed with more money?

- Nomination of a state administrator to deliver the restructure

- Demerge Pittwater to stop the cost bleeding and restore local governance

- to restructure for a leaner ship, or help us demerge

- to approve a thorough independent review to end a bloated bureaucracy.

The Pittwater Special Rate Improvement Plan

- Upgrade and retrofit infrastructure through carefully targeted, high priority ‘on ground works’

- Schedule of projects to be incorporated into Pittwater Council’s Annual Delivery Program

- Funding derived from the SRV will be distributed across the program of works over the 10 year period

- The Pittwater SRV will also support ‘seed’ funding within the works program

- Funding proportions may vary from year to year to achieve economic efficiency through the pooling of funds

- Reporting to be undertaken to ensure transparency